45l tax credit requirements

Since 2012 blower door air leakage tests have become mandatory tests regardless of the path chosen for compliance. Section 45L provides a credit to an eligible contractor who constructs a qualified new energy efficient home.

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services

A 1500 rebate for the purchase of an all-electric motorcycle.

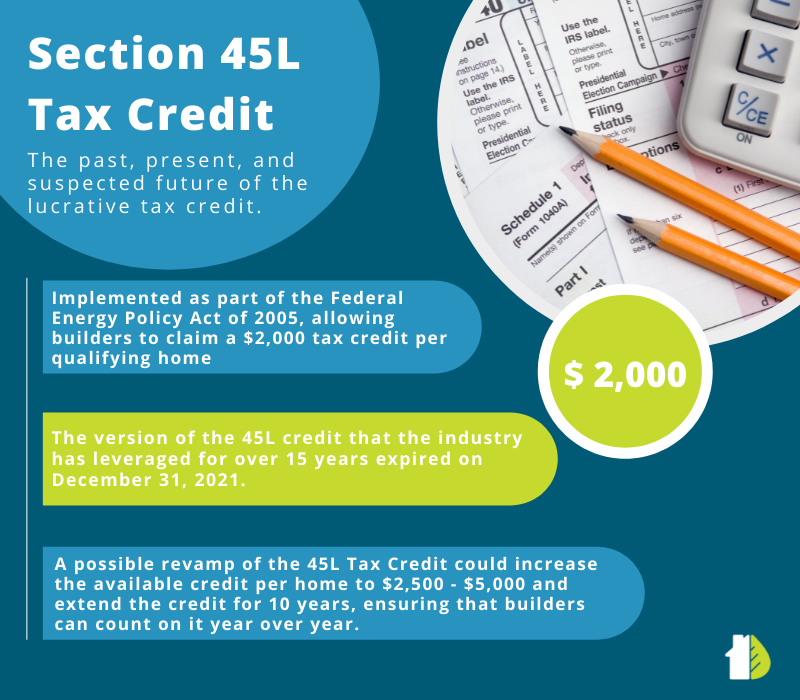

. For qualified new energy efficient homes other than manufactured homes. Starting in 2023 and extending. Originally expired at the end of 2021 45L tax credits have been retroactively extended under the same program through the end of 2022.

In the past the IRS issued this Notice Section 4 Part 3 that says the 45L Tax Credit is only applicable to buildings that are 3 stories or less. The blower door test consists of a large fan installed in the opening of. Below is a preview of one of the articles in the new KROST Quarterly Real Estate Issue titled Section 45L Tax Credits.

A 4000 rebate for the purchase of an all-electric vehicle that is not an electric motorcycle. We are not sure if this Notice. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient.

Acquired by a person from such eligible contractor for use as a residence during the taxable year. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal. The 45L Credit which currently only applies to homes leased or sold prior to January 1 2022 provides a 2000 dollar per home tax credit for homes that meet certain energy efficiency.

The Most Overlooked Tax Credit for Residential. Code 45L - New energy efficient home credit. The Illinois Affordable Housing Tax Credit IAHTC also known as the Donations Tax Credit provides a 050 state income tax credit for each 1 contributed to a qualified affordable.

2000 per qualified home Single family and multi-family projects up to. The 45L residential tax credit has recently been extended through the end of 2020This tax credit is equal to 2000 per residential unit or dwelling to the developers andor. Purchasers must apply for the.

As a reminder to qualify for the 45L tax credit properties must incorporate energy-efficient features such as high R-value insulation and roofing HVAC systems andor windows. Tax Credits Rebates Savings. The 45L Energy Efficient Home Credit offers builders developers a 2000 federal tax credit per energy efficient home.

Section 45L requirements for a new energy-efficient home Before a property can be evaluated in terms of its energy efficiency it must meet certain requirements to be eligible. You can still claim the existing Section 45L tax credit through 2022 and also in prior years by amending any open year tax returns typically three years prior.

Section 45l Energy Tax Credit Past Present And Future Ekotrope

45l Federal Builder Tax Credit

45l Builder Tax Credit Tacoma Energy

The Home Builders Energy Efficient Tax Credit An Faq

Iacl 45 L Tax Credit Program Iacl 45l Tax Credit

One Year Extension Through 2021 For Energy Efficient Home Section 45l Tax Credit Warner Robinson Llc

Section 45l Homebuilders Claim 2021 Section 45l Atlanta Cpa

Everything You Need To Know About 45l Tax Credit Mom And More

45l Energy Efficient Tax Credits Engineered Tax Services

179d And 45l Energy Efficiency Incentives Extended Ics Tax Llc

Section 45l Tax Credit Case Study Apollo Energies Inc

45l Builder Tax Credit Spray Foam Insulators

Csg 45l Energy Efficiency Tax Credits

45l Tax Credit Congress Reinstates Tax Credit For Energy Efficient Homes Groundbreak Carolinas

New Energy Efficient Home Tax Credit 45l Fox Energy Specialists Texas Energy Code And Hers Rating Services